Evaluation¶

Introduction¶

Use the insurance scheme designed in the previous chapter.

First load the mortality predictions data.

d <- readRDS("pred_mort1.rds")

d <- na.omit(d)

Compute mortality losses as the difference between the observed mortality (mortality_rate) and the trigger we adopted previously. Subsequently, compute insurance pay as estimated from predicted mortality (predicted_mortality) using the same trigger.

trigger <- 0.20

d$loss <- pmax(0, d$mortality_rate - trigger)

d$pay <- pmax(0, d$predicted_mortality - trigger)

head(d, n=2)

## year season sublocation NDVI year_season stock_beginning loss

## 1 2008 SRSD BUBISA 1.4511091 2008_SRSD 168.3 0.00000000

## 2 2008 SRSD DIRIB GOMBO 0.9011262 2008_SRSD 118.3 0.07303467

## mortality_rate predicted_mortality pay

## 1 0.09150327 0.1797705 0.000000000

## 2 0.27303467 0.2016966 0.001696612

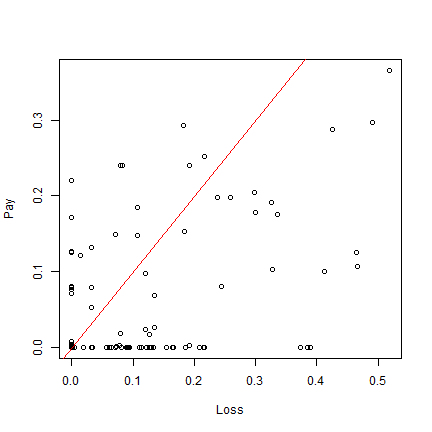

Below is a plot of pay as computed from predicted mortality versus observed. Ideally, if predictions are the same as observed then their plot should form a straight line.

plot(d$loss, d$pay, xlab="Loss", ylab="Pay")

abline(0,1, col="red")

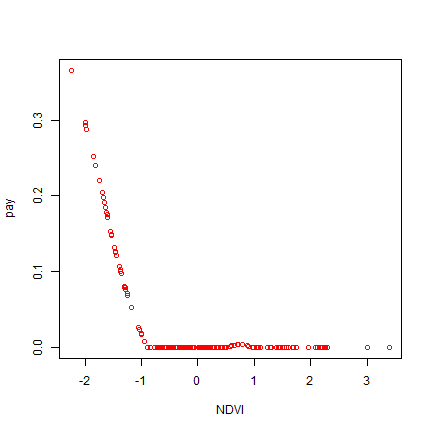

What do you make of the plots? What of a plot of payouts versus zNDVI?

plot(pay~NDVI, data=d, col="red")

We now need to assess the welfare of index insurance to the pastoralists. We use the certainty equivalent function.

library(agro)

agro::ce_income

## function (income, rho)

## {

## u <- utility(income, rho, scale = FALSE)

## ce_utility(u, rho)

## }

## <bytecode: 0x000001e99a16eaa8>

## <environment: namespace:agro>

Let us compute the premium that is paid for IBLI insurance as equivalent to the expected payouts with a mark up of 25%. We will basically compare the IBLI welfare based on the observed mortality (base) and predicted mortality (insurance).

markup <- 0.25

premium <- mean(d$pay) * (1 + markup)

premium

## [1] 0.04596454

base <- 1-d$mortality_rate

insurance_nomarkup <- base + d$pay

insurance <- insurance_nomarkup - premium

base <- base * 100

insurance <- insurance * 100

insurance_nomarkup <- insurance_nomarkup * 100

Compute CE with insurance (insurance) and without (base) respectively and compare them based on \(\rho\).

rho <- 2

ce_base <- ce_income(base, rho)

ce_ins25 <- ce_income(insurance, rho)

ce_ins_nomarkup <- ce_income(na.omit(insurance_nomarkup), rho)

ce_base

## [1] 73.25194

ce_ins25

## [1] 74.03087

ce_ins_nomarkup

## [1] 78.85488

ce_ins25 / ce_base

## [1] 1.010634

ce_ins_nomarkup/ce_base

## [1] 1.076489

head(d, n=2)

## year season sublocation NDVI year_season stock_beginning loss

## 1 2008 SRSD BUBISA 1.4511091 2008_SRSD 168.3 0.00000000

## 2 2008 SRSD DIRIB GOMBO 0.9011262 2008_SRSD 118.3 0.07303467

## mortality_rate predicted_mortality pay

## 1 0.09150327 0.1797705 0.000000000

## 2 0.27303467 0.2016966 0.001696612

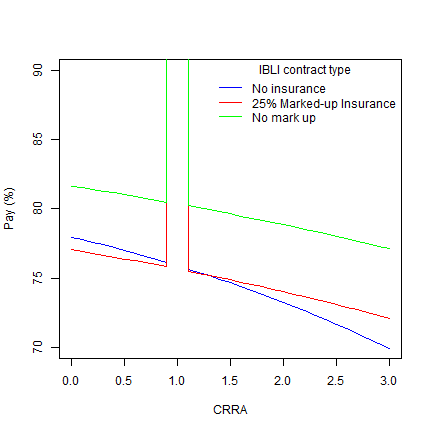

Compute CE over \(0 \leq \rho \leq 10\) and plot CE pay percentage when there is no mark up on insurance (ce_ins_nomarkup), when insurance is 25% marked up (ce_ins) and a case where no insurance is taken by pastrolist (ce_base).

rhos <- seq(0, 3, .1)

ce_base <- ce_ins <- ce_ins_nomarkup <- rep(NA, length(rhos))

for(i in 1:length(rhos)){

ce_base[i] <- ce_income(base, rhos[i])

ce_ins[i] <- ce_income(insurance, rhos[i])

ce_ins_nomarkup[i] <- ce_income(insurance_nomarkup, rhos[i])

}

inc <- seq(0.1, 1, 0.1)

plot(rhos, ce_base, type="l", col="blue", ylab= "Pay (%)", xlab="CRRA", cex=2, ylim=c(70, 90))

lines(rhos, ce_ins, col="red")

lines(rhos, ce_ins_nomarkup, col="green")

legend("topright", c("No insurance", "25% Marked-up Insurance", "No mark up"), lty=1, col=c("blue", "red", "green"), title = "IBLI contract type", bty = "n")

What do you observe from the graphs? What happens when you change the trigger to say 20%?

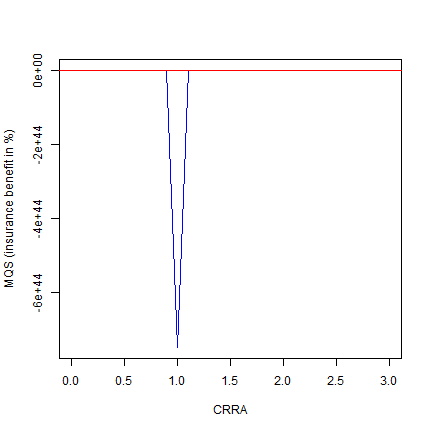

Let do the MQS test using the same values of CRRA and make a plot to determine pastrolist welfare with and without insurance.

ce_base <- ce_ins <- mqs <- rep(NA, length(rhos))

for(i in 1:length(rhos)){

ce_base[i] <- ce_income(base, rhos[i])

ce_ins[i] <- ce_income(insurance, rhos[i])

mqs[i] <- ce_ins[i] - ce_base[i]

}

inc <- seq(0.1, 1, 0.1)

plot(rhos, mqs*100, type="l", col="blue", ylab= "MQS (insurance benefit in %)", xlab="CRRA", cex=2)

abline(h=0, col="red")

From the plot you can observe that pastoralists with a risk aversion less than 1.5 do not derive any value from the insurance. However, those with higher risk aversion derive more benefit from the insurance as the fall above the zero line.

Simulation¶

Remember we predicted mortality previously based on zNDVI however there is uncertainty that is associated with our model. We will therefore conduct a simulation of pay based on 95% confidence interval of the model’s predictions.

Let us set up the environment including required library and data.

library(msir)

## Warning: package 'msir' was built under R version 4.3.1

dd <- na.omit(d)

Create a model that predicts mortality from zNDVI.

m <- loess.sd(dd$NDVI, dd$mortality_rate)

fitsd <- cbind(fit=m$model$fitted, sd=m$sd)

Let us sample 1000 times from the model we created previously.

ns <- 1000

sample <- apply(fitsd, 1, function(i) {

pmin(1, pmax(0, rnorm(ns, i[1], i[2])))

})

sample <- t(sample)

Compute insurance premium with 25% and with no markup from the samples

markup <- 0.2

premium <- mean(dd$pay) * (1 + markup)

and their corresponding CE at \(\rho=2\).

out_nomarkup <- out_ins <- out_base <- rep(NA, ns)

rho = 2

for (i in 1:ns) {

base <- 1- sample[,i]

insurance_nomarkup <- base + dd$pay

insurance <- insurance_nomarkup - premium

out_base[i] <- ce_income(100*base, rho)

out_ins[i] <- ce_income(100*insurance, rho)

out_nomarkup[i] <- ce_income(100*insurance_nomarkup, rho)

}

mean(out_base)

## [1] 73.34839

mean(out_ins)

## [1] 74.3992

mean(out_nomarkup)

## [1] 78.96075

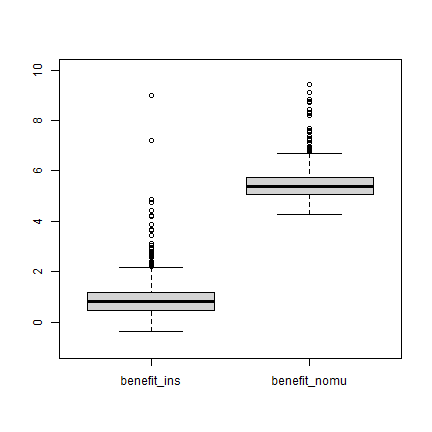

Make some plots.

benefit_ins <- out_ins - out_base

benefit_nomu <- out_nomarkup - out_base

b <- cbind(benefit_ins, benefit_nomu)

boxplot(b, ylim=c(-1,10))

The graph illustrates that the contract passes the welfare MQS test.