Design¶

Introduction¶

Now that we have a relationship between NDVI and mortality, we can design an insurance contract.

Load mortality predictions made the previous section.

d <- readRDS("pred_mort2.rds")

Remove some of the higher mortality predictions that occur with high ndvi. They are not relevant for us.

d$predicted_mortality[d$NDVI > 0.1] <- 0.1

Let us find a trigger above which the insurance pays. We set it so that we expect the insurance to pay out once every five years.

trigger <- quantile(d$predicted_mortality, 0.8)

round(trigger, 2)

## 80%

## 0.19

The trigger first occurs at this zNDVI

tndvi <- max(d$NDVI[d$predicted_mortality > trigger])

round(tndvi, 2)

## [1] -0.8

The payout — in units of the monetary value of TLU — can be computed as follows

d$pay <- pmax(0, d$predicted_mortality - trigger)

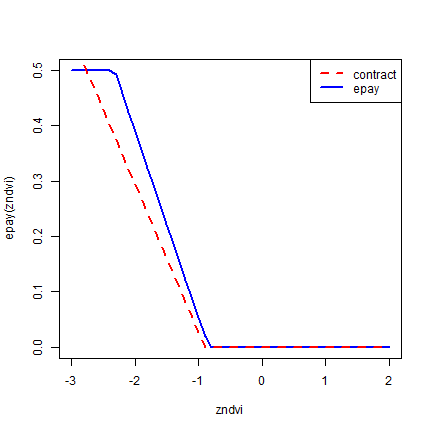

plot(d$NDVI, d$pay, cex=.1, xlab="NDVI", ylab="payout")

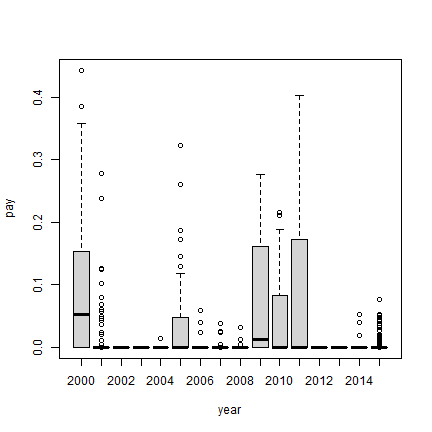

which is distributed over households, by years as follows

boxplot(pay~year, data=d)

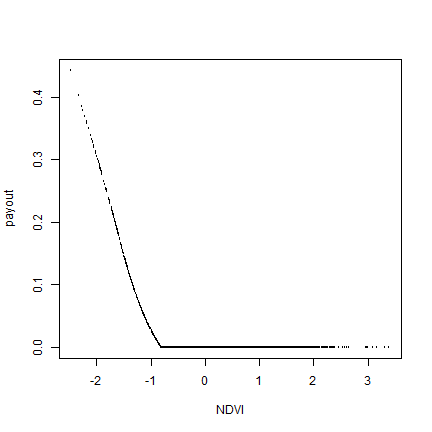

We can simplify the relationship between NDVI and mortality like this

nd <- d[d$NDVI < tndvi, ]

m <- lm(pay ~ NDVI, data=nd)

plot(pay ~ NDVI, data=nd, cex=.1)

abline(m, col="red")

cf <- coefficients(m)

cf

## (Intercept) NDVI

## -0.2402589 -0.2675110

Contracts¶

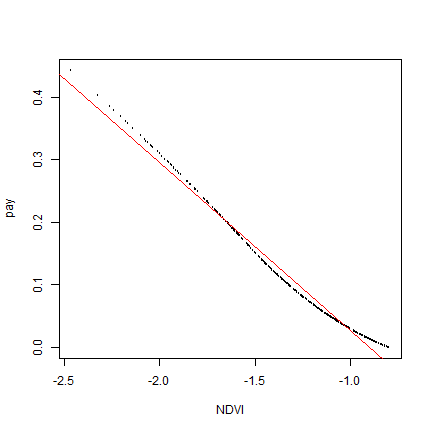

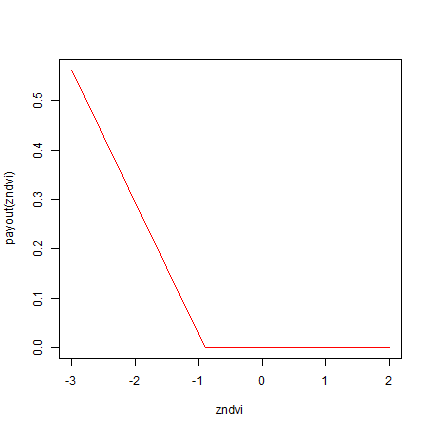

We can now design different contracts. The first would pay out according the model m above

payout <- function(zNDVI) {

pmax(0, -0.24 + -0.2675 * zNDVI)

}

zndvi <- seq(-3, 2, .1)

plot(zndvi, payout(zndvi), type="l", col="red")

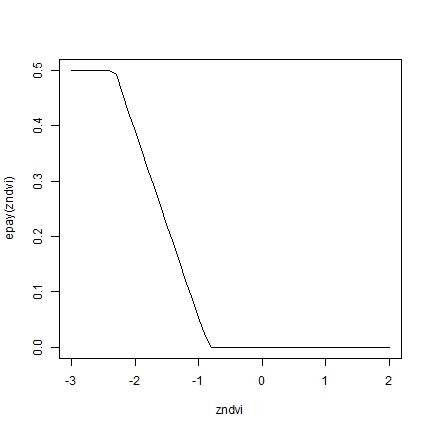

Another contract, folling Vrieling et al’s early payout scheme, triggers payouts when zNDVI is less than -0.842.

# need to adjust for payout scale (not TLUs?)

epay <- function(zNDVI, trigger=-0.842, exit=-2.326, frac=0.5) {

zNDVI <- pmax(zNDVI, exit)

frac * pmax( 0, (trigger-zNDVI) / (trigger-exit) )

}

plot(zndvi, epay(zndvi), type="l")

Plot the payout functions together.

plot(zndvi, epay(zndvi), col="blue", type="l", lwd=2)

lines(zndvi, payout(zndvi), type="l", col="red", lwd=2, lty=2)

legend("topright", c("contract", "epay"), col= c("red", "blue"), lty=c(2,1), lwd=2)