Area yield insurance¶

Introduction¶

Here we consider an “area-yield” insurance contract that triggers if the average rice yield of an insurance zone is 10% below the zone’s long-term rice yield.

If yields are below this threshold, the contract makes payouts equivalent to the value of 90% of the zone’s long-term average yield minus the observed zonal rice yield for that season. The actual amount paid to a household depends on the area insured by a household.

Basics¶

First a refresher. Below y is a zone’s crop yield in season (time) t; and y_z is the zone’s long-term average rice yield. Yields are expressed in kg/ha.

get_payout <- function(y, y_z, trigger, price){

pmax( (trigger * y_z) - y, 0) * price

}

To see how that works. Assume we observed the following sequence of rice yields.

yields <- seq(500, 2500, 100)

mean_yield <- mean(yields)

yields

## [1] 500 600 700 800 900 1000 1100 1200 1300 1400 1500 1600 1700 1800 1900

## [16] 2000 2100 2200 2300 2400 2500

mean_yield

## [1] 1500

We set the rice price to $0.23 per kg.

price <- 0.23

Now we can compute payouts

payout <- get_payout(yields, mean_yield, trigger=0.9, price=price)

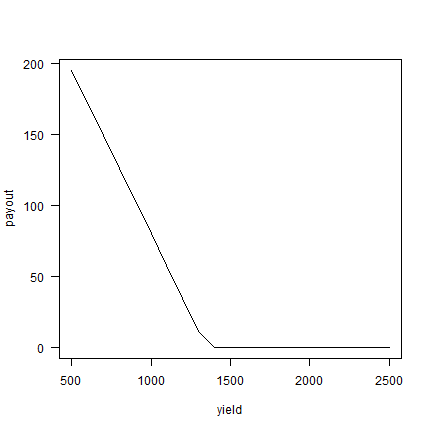

plot(yields, payout, type="l", xlab="yield", ylab="payout", las=1)

If insurance did not cost any money, income could be computed like this.

rice_income <- yields * price

total_income <- rice_income + payout

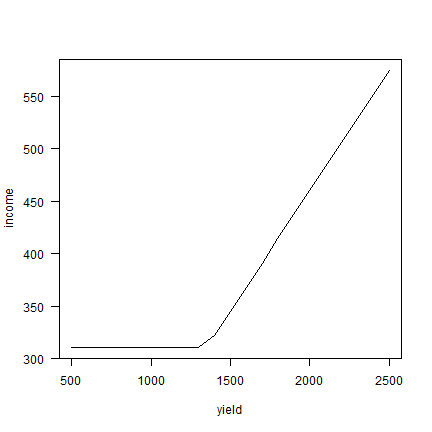

plot(yields, total_income, type="l", xlab="yield", ylab="income", las=1)

This shows that, thanks to insurance, income has a floor of $310.

The certainty equivalent without this insurance (not considering the premium, or other sources of income) would be

library(agrodata)

agro::ce_income(rice_income, rho=1.5)

## [1] 295.8926

And with insurance it would be

agro::ce_income(total_income, rho=1.5)

## [1] 375.0724

A more realistic situation might be a household that has additional income of $100 per year and that the insurance costs $50 per year.

rice_income <- yields * price

insurance_income <- payout - 50

total_income <- rice_income + insurance_income

agro::ce_income(rice_income, rho=1.5)

## [1] 295.8926

agro::ce_income(total_income, rho=1.5)

## [1] 323.1536

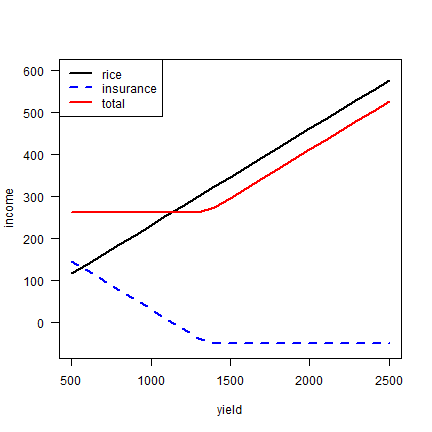

The certainly-equivalent income with insurance is still higher. We can plot that:

plot(yields, rice_income, type="l", xlab="yield", ylab="income", las=1, ylim=c(-60,600), lwd=2)

lines(yields, insurance_income, col="blue", lty=2, lwd=2)

lines(yields, total_income, col="red", lwd=2)

legend("topleft", c("rice", "insurance", "total"), col=c("black", "blue", "red"), lty=c(1,2,1), lwd=2)

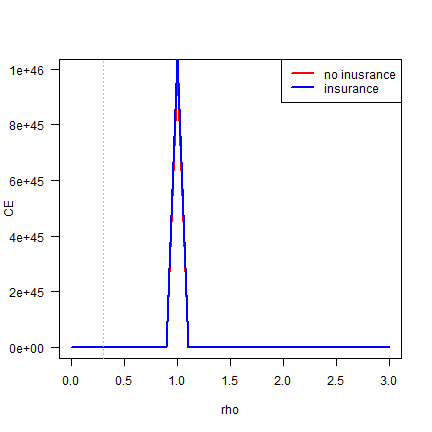

CE depends on rho

rho <- seq(0,3,.1)

ce_rice <- sapply(rho, function(r) agro::ce_income(rice_income, rho=r))

ce_tot <- sapply(rho, function(r) agro::ce_income(total_income, rho=r))

plot(rho, ce_rice, col="red", type="l", las=1, ylab="CE", lwd=2)

lines(rho, ce_tot, col="blue", lwd=2)

legend("topright", c("no inusrance", "insurance"), col=c("red", "blue"), lty=1, lwd=2 )

# certainty equivalents are the same at

i <- which.min(abs(ce_tot - ce_rice))

rho[i]

## [1] 0.3

abline(v=rho[i], lty=3, col="gray")

Tanzania households¶

Now get the household data from the previous chapter.

z <- readRDS("hh_rice_yield.rds")

head(z)

## zone year region fid y n y_zt y_z y_dz

## 1 Maore N 2003 Northern_zone 208 3000.000 13 1360 1600 0.85

## 2 Maore N 2003 Northern_zone 228 1360.000 13 1360 1600 0.85

## 3 Maore N 2003 Northern_zone 267 2560.000 13 1360 1600 0.85

## 4 Maore N 2003 Northern_zone 275 1050.000 13 1360 1600 0.85

## 5 Maore N 2003 Northern_zone 255 840.000 13 1360 1600 0.85

## 6 Maore N 2003 Northern_zone 215 1923.077 13 1360 1600 0.85

Compute payouts per ha for each zone.

z$payout <- get_payout(z$y_zt, z$y_z, 0.9, price)

head(z)

## zone year region fid y n y_zt y_z y_dz payout

## 1 Maore N 2003 Northern_zone 208 3000.000 13 1360 1600 0.85 18.4

## 2 Maore N 2003 Northern_zone 228 1360.000 13 1360 1600 0.85 18.4

## 3 Maore N 2003 Northern_zone 267 2560.000 13 1360 1600 0.85 18.4

## 4 Maore N 2003 Northern_zone 275 1050.000 13 1360 1600 0.85 18.4

## 5 Maore N 2003 Northern_zone 255 840.000 13 1360 1600 0.85 18.4

## 6 Maore N 2003 Northern_zone 215 1923.077 13 1360 1600 0.85 18.4

Now we can compute an insurance premium (per ha) for each zone z. First we determine the actuarially fair price where the premiums paid are equal to the expected value of compensation (payouts) paid.

pay_ha_year <- tapply(z$payout, z$year, mean)

pay_ha_year

## 2003 2004 2005 2006 2007 2008 2009 2010

## 14.083087 0.427141 2.942412 6.951119 46.973121 0.000000 2.379310 0.000000

## 2011 2012

## 0.000000 17.541482

afp <- mean(pay_ha_year)

afp

## [1] 9.129767

Let’s assume a markup of 20% (per ha)

premium <- round(afp, 1) * 1.2

premium

## [1] 10.92

income¶

For each household we can now compute income with and without insurance.

z$income <- z$y * price

z$income_with_ins <- z$income + z$payout - premium

head(z)

## zone year region fid y n y_zt y_z y_dz payout income

## 1 Maore N 2003 Northern_zone 208 3000.000 13 1360 1600 0.85 18.4 690.0000

## 2 Maore N 2003 Northern_zone 228 1360.000 13 1360 1600 0.85 18.4 312.8000

## 3 Maore N 2003 Northern_zone 267 2560.000 13 1360 1600 0.85 18.4 588.8000

## 4 Maore N 2003 Northern_zone 275 1050.000 13 1360 1600 0.85 18.4 241.5000

## 5 Maore N 2003 Northern_zone 255 840.000 13 1360 1600 0.85 18.4 193.2000

## 6 Maore N 2003 Northern_zone 215 1923.077 13 1360 1600 0.85 18.4 442.3077

## income_with_ins

## 1 697.4800

## 2 320.2800

## 3 596.2800

## 4 248.9800

## 5 200.6800

## 6 449.7877

certainty equivalents by household¶

hh <- aggregate(z[, c("income", "income_with_ins")], z[,"fid", drop=FALSE], function(i) agro::ce_income(i, 1.5))

hh$benefit <- (hh$income_with_ins - hh$income)

hh$rel_benefit <- hh$benefit/ hh$income

head(hh)

## fid income income_with_ins benefit rel_benefit

## 1 4 131.7353 225.3080 93.572694 0.710308520

## 2 5 512.1919 500.4867 -11.705170 -0.022853097

## 3 6 828.1967 817.1718 -11.024975 -0.013312024

## 4 7 883.3441 885.5298 2.185758 0.002474413

## 5 8 274.1715 263.1199 -11.051632 -0.040309187

## 6 9 187.1586 175.7295 -11.429099 -0.061066393

mean(hh$benefit)

## [1] 6.934037

quantile(hh$benefit)

## 0% 25% 50% 75% 100%

## -66.480544 -10.356437 -4.081677 4.582311 340.715845

So, at the individual level, the contract meets the welfare test if you use the mean, but not if you use the median.

certainty equivalents by zone¶

zz <- aggregate(z[, c("income", "income_with_ins")], z[,"zone", drop=FALSE], function(i) agro::ce_income(i, 1.5))

zz$benefit <- (zz$income_with_ins - zz$income)

zz$rel_benefit <- zz$benefit/ zz$income

head(zz)

## zone income income_with_ins benefit rel_benefit

## 1 Maore N 157.2417 219.4529 62.211188 0.395640493

## 2 Maore SE 261.7988 255.2649 -6.533827 -0.024957441

## 3 Maore SW 193.5088 213.3387 19.829944 0.102475686

## 4 Ndungu E 253.1700 250.9713 -2.198716 -0.008684741

## 5 Ndungu N 301.5164 305.4767 3.960330 0.013134708

## 6 Ndungu S 214.4688 191.5201 -22.948608 -0.107002102

mean(zz$benefit)

## [1] 17.48121

quantile(zz$benefit)

## 0% 25% 50% 75% 100%

## -22.948608 -5.414573 10.599094 45.428325 62.211188

barplot(sort(zz$rel_benefit), ylab="relative benefit", xlab="zone", las=1)

So, at the zone level, the contract meets the welfare test both for the mean and the median (at rho=1.5).